European Canned Tuna Market Forecast to Surpass USD 5 Billion by 2035, Driven by Sustainability and Innovation

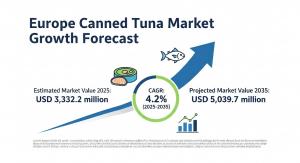

NEWARK, DE, UNITED STATES, August 6, 2025 /EINPresswire.com/ -- The European canned tuna market is gearing up for a decade of transformative growth, projected to expand from an estimated USD 3,332.2 million in 2025 to USD 5,039.7 million by 2035, at a compound annual growth rate (CAGR) of 4.2%. This steady and promising expansion comes at a time when manufacturers are confronting a dual challenge: satisfying the evolving expectations of health-conscious, eco-aware consumers while ensuring long-term business resilience and innovation.

For manufacturers seeking to capture market share in this high-potential category, the message is clear: sustainability, convenience, and product premiumization are now essential—not optional.

Convenience Meets Conscious Consumption

Canned tuna has long been a European pantry staple due to its affordability, versatility, and long shelf life. However, today's market drivers have evolved. The modern consumer demands not just convenience, but also transparency, traceability, and nutritional value.

In response, major players like John West, Princes, and Thai Union have introduced product lines that not only meet but exceed environmental and quality standards. John West’s new line of flavoured, sustainably sourced tuna in eco-friendly pouches, launched in April 2024, is already reshaping expectations around what canned tuna can be. Meanwhile, Princes’ partnership with a top European retailer in March 2024 highlights a strategic move toward mainstreaming ocean conservation messaging.

Thai Union’s introduction of a tuna traceability system, giving consumers real-time information about the origin of their seafood, exemplifies the kind of innovation that builds trust and loyalty in a saturated market.

Shifting Market Dynamics: Growth Acceleration from H2 2025

While the European canned tuna market grew modestly in 2024 (1.8% in H1, 2.6% in H2), growth in 2025 is expected to escalate, with 3.3% in H1 and a remarkable 4.5% in H2. This trajectory marks a significant shift in momentum, reflecting both growing consumer demand and increased production capabilities.

The increase in H2 2025 specifically signals strong seasonal or promotional uptake and reflects well on manufacturers’ efforts to align product development and marketing with evolving consumer values.

Rising Demand for Premium and Value-Added Products

Europe is also seeing a pronounced shift toward premium and value-added canned tuna products. From olive oil-infused gourmet tuna to organic, non-GMO, and line-caught variants, brands are elevating the category to appeal to sophisticated palates and health-driven consumers.

This trend aligns with broader shifts toward protein-centric diets and functional foods. German consumers, for instance, are gravitating toward yellowfin and bluefin tuna, prized for their superior taste and nutritional profile. In markets like Germany, premiumisation is no longer a niche—it’s a growth engine.

Packaging and Product Form Innovation

The chunk form of canned tuna has emerged as the leading product form, capturing 30% of the product form market by 2025. Its adaptability for salads, sandwiches, and quick meals makes it the go-to choice for time-starved, health-conscious consumers. Coupled with the rise in recyclable and biodegradable packaging, chunk tuna is fast becoming the preferred product for retailers and consumers alike.

In terms of product type, canned light tuna—typically derived from skipjack or yellowfin—has gained popularity due to its mild flavour and lower mercury content, making it particularly attractive to health-focused demographics and Mediterranean diet enthusiasts.

Country-Level Performance: Opportunities for Localised Strategies

Spain, Italy, France, and Germany collectively account for 85% of the market share, with Spain leading at 32%. However, the United Kingdom is a dark horse, showing strong upward potential fueled by its consumer focus on convenience and sustainability. Brands that earn MSC certification and adopt recyclable packaging are seeing increased shelf space and customer loyalty in the UK.

Germany’s market is also undergoing rapid change, driven by a shift to organic and premium offerings. The demand for non-GMO, ethically sourced tuna is growing, providing manufacturers with opportunities to differentiate through product origin and health claims.

Market Structure: Tiered by Scale, Innovation, and Local Relevance

Europe’s canned tuna industry is stratified across three tiers:

Tier 1: Global giants like Grupo Calvo (25%), John West (20%), and Princes (10%) dominate the space with wide distribution and deep investments in sustainability and R&D.

Tier 2: Regional players such as Orkla Group and Sealord Group specialize in niche offerings, especially in the organic and clean-label segments.

Tier 3: Local enterprises, while smaller, excel in regional flavor profiles and customized product lines, giving them a competitive edge in localized markets.

This layered structure offers unique collaboration opportunities across tiers—especially for manufacturers seeking to expand into emerging regional markets or co-develop premium SKUs with local producers.

Request Europe Canned Tuna Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22079

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Looking Ahead: A Blueprint for Manufacturers

As the market heads toward the USD 5 billion milestone by 2035, manufacturers must think beyond basic canned goods. Innovation in sourcing, packaging, product development, and customer education will define future winners.

Manufacturers can no longer afford to view sustainability as a marketing checkbox. Instead, it must be embedded into operations, supply chains, and brand narratives. Consumer demand for responsibly caught, health-focused, and value-enhanced tuna is shaping the next chapter of growth across Europe.

For manufacturers ready to take the lead, the European canned tuna market is not just expanding—it is evolving.

Explore FMI’s related ongoing Coverage in Food and Beverage Domain

Europe Winter Tourism Market:https://www.futuremarketinsights.com/reports/europe-winter-tourism-sector-outlook

Europe Tartrazine Market:https://www.futuremarketinsights.com/reports/europe-tartrazine-market

Europe Wood Vinegar Market:https://www.futuremarketinsights.com/reports/europe-wood-vinegar-market

These insights are especially valuable for stakeholders in packaging, pharmaceutical logistics, food and beverage, and therapeutic product innovation.

These insights offer valuable perspectives for packaging engineers, pharmaceutical supply chain experts, and personal care product manufacturers looking to align with emerging trends in cold-based product solutions.

Editor’s Note:

This release is based solely on official industry-sourced data regarding the European Canned Tuna Market Outlook from 2025 to 2035. The forecast indicates a steady CAGR of 4.2%, taking the market from USD 3,332.2 million in 2025 to USD 5,039.7 million by 2035. All data reflects actual market developments, recent activities, and future projections without external AI-generated content.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.