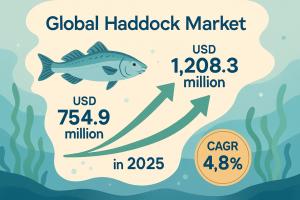

Haddock Market Forecasts a New Era to USD 1,208.3 million by 2035, Driven by Innovation Amidst Supply Challenges

Despite supply challenges, haddock market is poised for growth, driven by surging consumer demand for value-added, traceable, and sustainably sourced products.

NEWARK, DE, UNITED STATES, August 4, 2025 /EINPresswire.com/ -- A new analysis reveals the global haddock market is set for sustained growth, with the industry's value projected to rise from USD 754.9 million in 2025 to USD 1,208.3 million by 2035, a Compound Annual Growth Rate (CAGR) of 4.8%. This positive outlook comes despite significant recent supply-side challenges, presenting a clear path for manufacturers to capitalize on evolving consumer demand by focusing on innovation, sustainability, and transparency.

The market's resilience is tied to the rising global appetite for whitefish. Consumers are increasingly seeking out mild-flavored, low-fat haddock in convenient, value-added formats such as frozen fillets and ready-to-cook meals. This demand signals a crucial shift for manufacturers, who must now navigate a complex landscape of fishery regulations while meeting a growing desire for high-quality, ethically sourced products.

One of the most pressing challenges facing the industry today is a dramatic reduction in fishing quotas. In May 2023, federal regulators in the USA imposed an 80% cut in haddock quotas in the Gulf of Maine, a measure taken to prevent a potential population collapse. This decision, though met with concern from regional fishermen, underscores the critical need for a stable and sustainable supply chain. For manufacturers, this is not just a challenge but an opportunity to build trust through responsible sourcing and product transparency.

A Fresh Approach to a Growing Market

At the heart of the industry’s growth is fresh haddock, which is expected to command a 53.4% market share in 2025. This dominance is a direct result of consumer preference for minimally processed fish. Health-conscious shoppers in both coastal and urban areas are prioritizing haddock for its clean taste and nutritional benefits. Manufacturers who can ensure a consistent supply of fresh fillets, supported by a robust cold chain infrastructure, are well-positioned to meet this demand.

Supermarkets are key to reaching this expanding consumer base, projected to be the leading distribution channel with a 19.7% share in 2025. Their dominance is fueled by a wide consumer reach and advanced refrigeration systems. Manufacturers can leverage this by partnering with supermarkets to offer both private-label and branded products, using in-store promotions and educational displays to highlight the benefits and origins of their haddock.

Innovating for Consumer Trust and Growth

The dynamics of the haddock market are shaped by two primary forces: a surging demand for healthy, mild whitefish and the influence of stringent fishery regulations. Haddock's appeal as a lean protein with a low-mercury content makes it a premium choice for modern diets. Manufacturers are responding by offering a range of convenient options, from grilled and breaded portions to frozen and vacuum-packed fillets, which preserve freshness and reduce waste.

The industry is also prioritizing fishery management and certification standards. In regions like the North Atlantic, quota systems are in place to prevent overfishing. Leading seafood producers are increasingly seeking certification from reputable bodies to build consumer confidence and ensure proper sourcing. By adopting advanced traceability systems, manufacturers can maintain transparency in their supply chain, allowing consumers to track the origin of their haddock and reinforcing the product's integrity.

Regional Growth: A Blueprint for Manufacturers

Regional insights provide a clear blueprint for manufacturers looking to tap into specific consumer trends. The United States is a key growth region, with a projected 4.1% CAGR through 2035. American consumers are drawn to frozen, pre-portioned seafood with Marine Stewardship Council labels and verifiable North Atlantic origins. Manufacturers can thrive here by supplying shelf-ready cuts that meet traceability requirements and by collaborating with retailers on promotions timed to capture seasonal demand, such as during Lent.

In the United Kingdom, which holds a 3.7% CAGR, haddock remains a staple in fish-and-chip outlets, but household shoppers are increasingly choosing skinless, boneless fillets. Manufacturers can appeal to this trend by highlighting the omega-3 content and responsibly sourced labels on their products. Innovations in packaging, such as skin-pack technology, are also helping to extend shelf life and reduce waste.

Germany’s demand for haddock is expected to grow at a 3.2% CAGR, driven by a preference for individually quick frozen (IQF) fillets that provide portion control. Manufacturers can position haddock as a sustainable alternative to overfished cod, appealing to environmentally aware consumers. Convenience is also a key factor, with demand for flavor-infused and herb-butter portions rising in urban households.

France, with a 3.4% CAGR, values culinary versatility. Smoked loins and seasoned portions are popular in both supermarkets and foodservice outlets. Manufacturers can innovate with Mediterranean herb marinades and vacuum-skin packaging, while promoting the ethical-harvest narratives that resonate with France’s seafood-literate consumers.

Finally, in Italy, haddock sales are forecast to grow at a 2.9% CAGR, as filleted and marinated haddock is embraced in stews, pasta sauces, and upscale ready meals. Manufacturers can leverage the link between seafood intake and wellness, promoting haddock’s low-fat attributes through social media campaigns and partnerships with food influencers.

Navigating the Competitive Landscape

The haddock industry is composed of a mix of dominant players, key suppliers, and emerging processors. Icelandic Group, Leroy Seafood, and Marine Harvest are among the leaders, with vertically integrated operations and extensive export networks. High Liner Foods, Young's Seafood, and Kroger are key suppliers, focusing on value-added processing and private-label offerings. Emerging players are making their mark by emphasizing eco-label certifications and traceability, proving that even regional processors can gain traction by aligning with modern consumer values.

Key Players:

Icelandic Group, Marine Harvest, Leroy Seafood, Young's Seafood, High Liner Foods, Fish Market, Kroger

Request Haddock Market Draft Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-22401

For more on their methodology and market coverage, visit https://www.futuremarketinsights.com/about-us.

Explore Related Insights

Animal Feed Market: https://www.futuremarketinsights.com/reports/animal-feed-market

Animal Feeds Microalgae Market: https://www.futuremarketinsights.com/reports/demand-for-microalgae-in-animal-feeds-sector

EDITOR’S NOTE:

This release is based exclusively on verified and factual market content derived from industry analysis by Future Market Insights. No AI-generated statistics or speculative data have been introduced. This release details opportunities in the haddock market for manufacturers. It highlights consumer trends and regional growth drivers shaping the industry's future.

Rahul Singh

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.